Enquire Now

Please provide your details to reserve space at Guardian Vaults.

Enquire Now

Please provide your details to reserve space at Guardian Vaults.

Enquire Now

Please provide your details to reserve space at Guardian Vaults.

Enquire Now

Please provide your details to reserve space at Guardian Vaults.

Enquire Now

Please provide your details to reserve space at Guardian Vaults.

Bitcoin Trader, explain the basics of Bitcoin & Cryptocurrency Investment, cold wallets and their recommendations for secure storage.

1. The Digital Economy

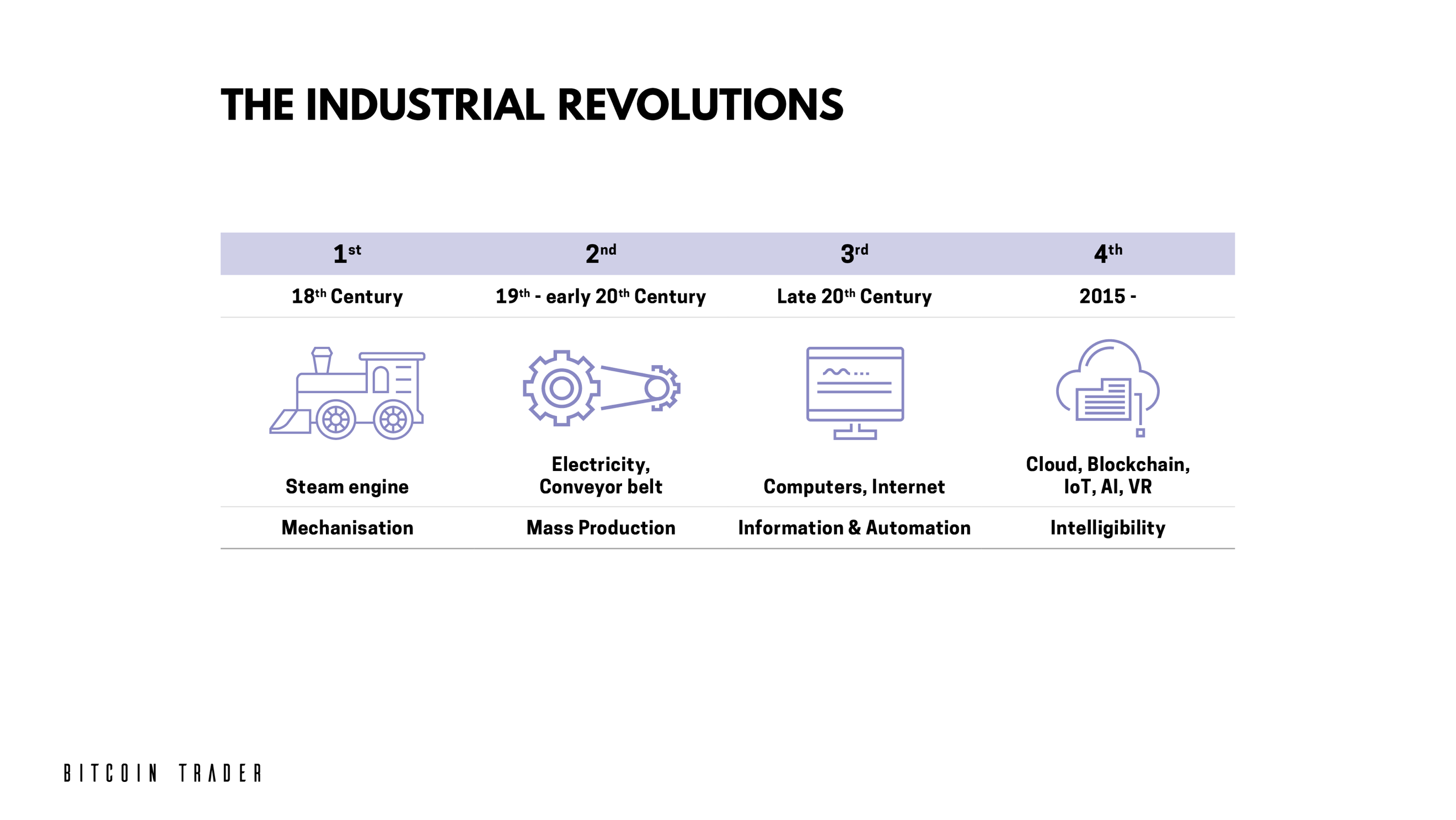

The world economy is in transition. In the First Industrial Revolution we moved to mechanisation, then mass production, into information technology. We have arrived at the Fourth Industrial revolution: Intelligibility – IoT, Cloud, Blockchain, AI, VR = machine to machine transactions that interact digitally. Today the majority of global trade and GDP is digital goods. Why trade digitally with a paper currency? The foundation of a digital economy is a digital currency, specifically, a “cryptocurrency” – protected by an unbreakable cryptographic algorithm. Bitcoin is the first cryptocurrency; both a store of value and a system of exchange

2. Don’t understand cryptography?

Most people don’t know how their fridge works, luckily it still keeps your milk cold. If you really want to know about mining, blockchains, hash algorithms, merkle trees and more, we can give you the tech specs. Or you can benefit on the exceptional investment opportunity without drilling into the details. Ironically, the lack of mainstream understanding is what enables early adopters to reap the highest returns.

3. Bitcoin is a Store of Wealth & System of Exchange

A New Asset Class:

- Exceptional Returns

- 500% growth in 2017

- Low Correlation across standard asset classes

- Instant Portfolio Diversification

A New Kind of Money:

- Hedge against Geo-Political instability & declining global fiat values

- Revolution in FinTech

- The Digital Reserve Currency

- Facilitator of New Markets: Banking the 2 billion Unbanked

- Safe, Secure, Un-hackable

The ultimate investment.

How Do I Store Bitcoin?

When you buy cryptocurrency you require storage simultaneously. Like when you buy a coffee at a cafe, you need a cup at the exactly the same time. In the crypto world no one provides the cup; you bring your own. A crypto cup is a “wallet” and there are two kinds: “hot” and “cold”.

A “hot wallet” refers to an electronic wallet that exists as an app on your computer or smartphone and is owned by and / or linked to a digital currency exchange website. Since the wallet is connected to the Internet you can spend your cryptocurrency at any time, but it also exposes you to risk: Digital currency exchange websites are often hacked and shut down. We don’t recommend hot wallets for large tranches of cryptocurrency – or carrying $25,000 cash in your back pocket for the next decade.

A “cold wallet” stores cryptocurrency on an offline external hardware device (like a back up drive), that can’t be hacked. Further, when you activate a cold wallet the device generates “recovery seeds”; twenty-four random words, unique to your wallet. These seeds are like a password that can be used to recover your cryptocurrency on-line if your device is lost, stolen or compromised. Most importantly, unlike a hot wallet on an exchange, you own the cold wallet device so you’re always in control of your cryptocurrency investment.

Choosing the right device and establishing it correctly requires a significant amount of technical expertise. Experienced clients supply their own cold wallet storage; if you’re a new investor we can assign an established device to your order.

Where is my cold wallet kept?

Throughout the acquisition process Bitcoin Trader keeps your activated cold wallet device in a safety deposit box, inside a multi-layered security vault, in an undisclosed location. In fact, your cold wallet device waits inside the vault before the trade. Once you’ve completed an order form and your fiat funds have cleared, the trade is made and the supplier transfers your cryptocurrency allocation directly from their wallet to yours – inside the vault. The only thing moving is the code. It’s a bit like storing a credit card inside a vault, then transferring funds onto the account via internet banking. This process was established to ensure your cryptocurrency could not be hacked or stolen throughout acquisition, and interception of your cold wallet storage device was impossible.

Since not many people want to keep their future millions under the mattress; or their cold wallet in the cupboard – we advocate storing your cold wallet device in a safety deposit box within a secure vault. That’s why we’ve partnered with Guardian Vaults.

The Vaulting Process

Join our Free Masterclass on October 5th at Guardian Vaults Sydney. Limited Availability, register here

Join our Free Masterclass on October 19th at Guardian Vaults Melbourne. Limited Availability, register here

_______________________________________________________________________________

Bitcoin Trader is a digital currency brokerage firm providing a buy and hold strategy for high volume cryptocurrency investments.

Disclaimer: This content is for informational purposes only. It does not constitute investment or financial advice. Any information, material or commentary is intended to provide general information only. Information contained in this document has been obtained from sources believed to be reliable, but BT Brokerage Services Pty Ltd trading as Bitcoin Trader, makes no representation as to its accuracy or completeness. Before acting on any information contained in this document, each person should consider its appropriateness having regard to their own or their clients’ individual objectives, financial situation and needs. You should obtain independent taxation, financial and legal advice relating to this information and consider it carefully before making any decision or recommendation.

Gold and Silver News

From Guardian Vaults

Why Buy Bitcoin?

Bitcoin Trader, explain the basics of Bitcoin & Cryptocurrency Investment, cold wallets and their recommendations for secure storage.

1. The Digital Economy

The world economy is in transition. In the First Industrial Revolution we moved to mechanisation, then mass production, into information technology. We have arrived at the Fourth Industrial revolution: Intelligibility – IoT, Cloud, Blockchain, AI, VR = machine to machine transactions that interact digitally. Today the majority of global trade and GDP is digital goods. Why trade digitally with a paper currency? The foundation of a digital economy is a digital currency, specifically, a “cryptocurrency” – protected by an unbreakable cryptographic algorithm. Bitcoin is the first cryptocurrency; both a store of value and a system of exchange

2. Don’t understand cryptography?

Most people don’t know how their fridge works, luckily it still keeps your milk cold. If you really want to know about mining, blockchains, hash algorithms, merkle trees and more, we can give you the tech specs. Or you can benefit on the exceptional investment opportunity without drilling into the details. Ironically, the lack of mainstream understanding is what enables early adopters to reap the highest returns.

3. Bitcoin is a Store of Wealth & System of Exchange

A New Asset Class:

- Exceptional Returns

- 500% growth in 2017

- Low Correlation across standard asset classes

- Instant Portfolio Diversification

A New Kind of Money:

- Hedge against Geo-Political instability & declining global fiat values

- Revolution in FinTech

- The Digital Reserve Currency

- Facilitator of New Markets: Banking the 2 billion Unbanked

- Safe, Secure, Un-hackable

The ultimate investment.

How Do I Store Bitcoin?

When you buy cryptocurrency you require storage simultaneously. Like when you buy a coffee at a cafe, you need a cup at the exactly the same time. In the crypto world no one provides the cup; you bring your own. A crypto cup is a “wallet” and there are two kinds: “hot” and “cold”.

A “hot wallet” refers to an electronic wallet that exists as an app on your computer or smartphone and is owned by and / or linked to a digital currency exchange website. Since the wallet is connected to the Internet you can spend your cryptocurrency at any time, but it also exposes you to risk: Digital currency exchange websites are often hacked and shut down. We don’t recommend hot wallets for large tranches of cryptocurrency – or carrying $25,000 cash in your back pocket for the next decade.

A “cold wallet” stores cryptocurrency on an offline external hardware device (like a back up drive), that can’t be hacked. Further, when you activate a cold wallet the device generates “recovery seeds”; twenty-four random words, unique to your wallet. These seeds are like a password that can be used to recover your cryptocurrency on-line if your device is lost, stolen or compromised. Most importantly, unlike a hot wallet on an exchange, you own the cold wallet device so you’re always in control of your cryptocurrency investment.

Choosing the right device and establishing it correctly requires a significant amount of technical expertise. Experienced clients supply their own cold wallet storage; if you’re a new investor we can assign an established device to your order.

Where is my cold wallet kept?

Throughout the acquisition process Bitcoin Trader keeps your activated cold wallet device in a safety deposit box, inside a multi-layered security vault, in an undisclosed location. In fact, your cold wallet device waits inside the vault before the trade. Once you’ve completed an order form and your fiat funds have cleared, the trade is made and the supplier transfers your cryptocurrency allocation directly from their wallet to yours – inside the vault. The only thing moving is the code. It’s a bit like storing a credit card inside a vault, then transferring funds onto the account via internet banking. This process was established to ensure your cryptocurrency could not be hacked or stolen throughout acquisition, and interception of your cold wallet storage device was impossible.

Since not many people want to keep their future millions under the mattress; or their cold wallet in the cupboard – we advocate storing your cold wallet device in a safety deposit box within a secure vault. That’s why we’ve partnered with Guardian Vaults.

The Vaulting Process

Join our Free Masterclass on October 5th at Guardian Vaults Sydney. Limited Availability, register here

Join our Free Masterclass on October 19th at Guardian Vaults Melbourne. Limited Availability, register here

_______________________________________________________________________________

Bitcoin Trader is a digital currency brokerage firm providing a buy and hold strategy for high volume cryptocurrency investments.

Disclaimer: This content is for informational purposes only. It does not constitute investment or financial advice. Any information, material or commentary is intended to provide general information only. Information contained in this document has been obtained from sources believed to be reliable, but BT Brokerage Services Pty Ltd trading as Bitcoin Trader, makes no representation as to its accuracy or completeness. Before acting on any information contained in this document, each person should consider its appropriateness having regard to their own or their clients’ individual objectives, financial situation and needs. You should obtain independent taxation, financial and legal advice relating to this information and consider it carefully before making any decision or recommendation.

Disclaimers: Guardian Vaults Holdings Pty Ltd, Registered Office, Scottish House, 100 William Street, Melbourne, Victoria, 3000. ACN 138618176 (“Guardian Vaults”) All rights reserved. Any reproduction, copying, or redistribution, in whole or in part, is prohibited without written permission from the publisher and/or the author. Information contained herein is believed to be reliable, but its accuracy cannot be guaranteed. It is not designed to meet your personal situation. Guardian Vaults, its officers, agents, representatives and employees do not hold an Australian Financial Services License (AFSL), are not an authorised representative of an AFSL and otherwise are not qualified to provide you with advice of any kind in relation to financial products. If you require advice about a financial product, you should contact a properly licensed or authorised financial advisor. The information is indicative and general in nature only and is prepared for information purposes only and does not purport to contain all matters relevant to any particular investment. Subject to any terms implied by law and which cannot be excluded, Guardian Vaults, shall not be liable for any errors, omissions, defects or misrepresentations (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (direct or indirect) suffered by persons who use or rely on such information. The opinions expressed herein are those of the publisher and/or the author and may not be representative of the opinions of Guardian Vaults, its officers, agents, representatives and employees. Such information does not take into account the particular circumstances, investment objectives and needs for investment of any person, or purport to be comprehensive or constitute investment or financial product advice and should not be relied upon as such. Past performance is not indicative of future results. Due to various factors, including changing market conditions and/or laws the content may no longer be reflective of current opinions or positions. You should seek professional advice before you decide to invest or consider any action based on the information provided. If you do not agree with any of the above disclaimers, you should immediately cease viewing or making use of any of the information provided.