Enquire Now

Please provide your details to reserve space at Guardian Vaults.

Enquire Now

Please provide your details to reserve space at Guardian Vaults.

Enquire Now

Please provide your details to reserve space at Guardian Vaults.

Enquire Now

Please provide your details to reserve space at Guardian Vaults.

Enquire Now

Please provide your details to reserve space at Guardian Vaults.

Guardian Vaults introduces you to Australian Diamond Portfolio, who’ve partnered with us as their secure storage partner. We’ve invited Anna Cisecki, to introduce you to the world of Argyle Diamonds. Whilst based in Sydney with an office at our Sydney Vault facility, the team at Australian Diamond Portfolio are happy to assist you wherever you may reside providing an end-to-end solution as the Diamond Investment Specialists.

INVESTORS INCREASINGLY BUYING RARE ARGYLE DIAMONDS

Whilst financial markets ended 2016 on a positive note, it was anything but smooth sailing, with the year characterised by distinct bouts of extreme volatility. First, we saw concerns about slowing global growth and falling oil prices, as well as a negative reaction to the implementation of even more extreme monetary policy in Japan. Mid-year, markets were in chaos, with an initial negative reaction to the unexpected Brexit vote, followed by a recovery which ultimately carried through to the end of the year, despite the surprise election victory of President Donald Trump.

Given the challenging political and economic outlook, we expect this volatility to be a permanent feature in financial markets, both in 2017 and indeed for many years to come. As a result, investors are increasingly look to alternative assets including gold, silver, art, and indeed rare coloured diamonds.

PINK DIAMONDS AS AN INVESTMENT

Why pink diamonds? Firstly, they’re not influenced by the speculative moods of equity markets that create major short-term fluctuations; there are no options, futures or short selling, nor is it a highly leveraged market. The absence of these factors, which can lead to significant levels of added volatility in financial markets, protects diamond investors from these market risks.

On a longer-term basis, rare pink diamonds are a scarce, finite resource with no new sources of supply in the pipeline for the foreseeable future. While prices for typical diamonds have generally remained flat over the past decade, pink diamond prices have seen more than healthy growth due their rarity and concerns about future supply. Rio Tinto’s Argyle mine in Western Australia’s Kimberley accounts for the bulk of the world’s pink diamonds – over 90% of global supply – and is currently expected to cease operating around 2020.

With closure imminent, pink diamonds have seen an average annualised growth rate of almost 13% per annum over the past decade, from January 2007 to 2017.

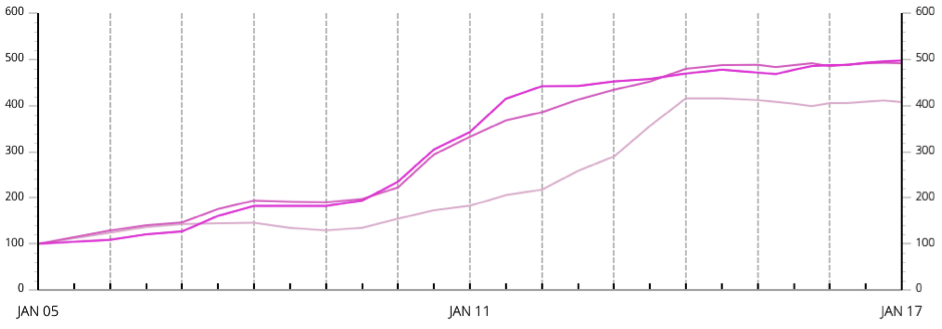

HISTORIC APPRECIATION OF MAIN PINK DIAMOND CLASSES

On the note of rarity, The Australian Business Review has made one of the most apt statements on the investment potential of these gems – “buying a pink diamond is like buying a painting by Pablo Picasso while he was alive. You know at some point they will run out and increase in value. We have always known it was a limited source and that a time would come when this fabulous fluke of nature would end, but there is a lack of appreciation for what this will mean. In another decade the Argyle Pink Diamond will emerge as the new Faberge egg, the thing myths are made of. The value of rarity is the most priceless factor.”

SO WHO’S BUYING PINK DIAMONDS?

Rare pink diamonds are not just the realm of the uber-wealthy; investors of all types and levels of the market are getting involved, from small private retail investors and wealth managers to financial advice groups, SMSF trustees and family offices. Entry level is typically about AU$20,000, which demonstrates the accessibility of this market to a large swathe of potential investors.

In Australia, the healthy appreciation in pink diamond prices means more and more people are looking to invest in the stones through their self-managed super funds. SMSF’s are able to invest in pink diamonds under the category of ‘collectables’, which also include provisions for asset classes such as works of art and vintage cars.

GETTING INTO THE MARKET

It’s important to note that not all diamonds, indeed not even all pink diamonds, can be considered investment diamonds.The majority of diamonds on the market are actually quite common, and realising a resale value close to the purchase price requires specialised knowledge.

Australian Diamond Portfolio (ADP) is an independent investment diamond brokerage that specialises in the acquisition of rare pink diamonds. ADP provides investors with an easy, end-to-end solution that encompasses every step of the investment process, as well as ongoing services including secure storage, insurance and ongoing valuations.

For more information I invite you to request our 2017 Pink Diamond Investment Guide, a great tool for interested investors to educate themselves further on pink diamonds as an investment. This guide is designed as an introduction for Australian investors interested in exposure to physical pink diamonds as part of a diversified portfolio.

Anna Cisecki,

Executive Director

If you’d like to get in touch with the team at Australian Diamond portfolio. Their contact details are below.

P: 02 9238 2727 | E: info@diamondportfolio.com.au

Investments

From Guardian Vaults

Investors Increasingly Buying Rare Argyle Diamonds

Guardian Vaults introduces you to Australian Diamond Portfolio, who’ve partnered with us as their secure storage partner. We’ve invited Anna Cisecki, to introduce you to the world of Argyle Diamonds. Whilst based in Sydney with an office at our Sydney Vault facility, the team at Australian Diamond Portfolio are happy to assist you wherever you may reside providing an end-to-end solution as the Diamond Investment Specialists.

INVESTORS INCREASINGLY BUYING RARE ARGYLE DIAMONDS

Whilst financial markets ended 2016 on a positive note, it was anything but smooth sailing, with the year characterised by distinct bouts of extreme volatility. First, we saw concerns about slowing global growth and falling oil prices, as well as a negative reaction to the implementation of even more extreme monetary policy in Japan. Mid-year, markets were in chaos, with an initial negative reaction to the unexpected Brexit vote, followed by a recovery which ultimately carried through to the end of the year, despite the surprise election victory of President Donald Trump.

Given the challenging political and economic outlook, we expect this volatility to be a permanent feature in financial markets, both in 2017 and indeed for many years to come. As a result, investors are increasingly look to alternative assets including gold, silver, art, and indeed rare coloured diamonds.

PINK DIAMONDS AS AN INVESTMENT

Why pink diamonds? Firstly, they’re not influenced by the speculative moods of equity markets that create major short-term fluctuations; there are no options, futures or short selling, nor is it a highly leveraged market. The absence of these factors, which can lead to significant levels of added volatility in financial markets, protects diamond investors from these market risks.

On a longer-term basis, rare pink diamonds are a scarce, finite resource with no new sources of supply in the pipeline for the foreseeable future. While prices for typical diamonds have generally remained flat over the past decade, pink diamond prices have seen more than healthy growth due their rarity and concerns about future supply. Rio Tinto’s Argyle mine in Western Australia’s Kimberley accounts for the bulk of the world’s pink diamonds – over 90% of global supply – and is currently expected to cease operating around 2020.

With closure imminent, pink diamonds have seen an average annualised growth rate of almost 13% per annum over the past decade, from January 2007 to 2017.

HISTORIC APPRECIATION OF MAIN PINK DIAMOND CLASSES

On the note of rarity, The Australian Business Review has made one of the most apt statements on the investment potential of these gems – “buying a pink diamond is like buying a painting by Pablo Picasso while he was alive. You know at some point they will run out and increase in value. We have always known it was a limited source and that a time would come when this fabulous fluke of nature would end, but there is a lack of appreciation for what this will mean. In another decade the Argyle Pink Diamond will emerge as the new Faberge egg, the thing myths are made of. The value of rarity is the most priceless factor.”

SO WHO’S BUYING PINK DIAMONDS?

Rare pink diamonds are not just the realm of the uber-wealthy; investors of all types and levels of the market are getting involved, from small private retail investors and wealth managers to financial advice groups, SMSF trustees and family offices. Entry level is typically about AU$20,000, which demonstrates the accessibility of this market to a large swathe of potential investors.

In Australia, the healthy appreciation in pink diamond prices means more and more people are looking to invest in the stones through their self-managed super funds. SMSF’s are able to invest in pink diamonds under the category of ‘collectables’, which also include provisions for asset classes such as works of art and vintage cars.

GETTING INTO THE MARKET

It’s important to note that not all diamonds, indeed not even all pink diamonds, can be considered investment diamonds.The majority of diamonds on the market are actually quite common, and realising a resale value close to the purchase price requires specialised knowledge.

Australian Diamond Portfolio (ADP) is an independent investment diamond brokerage that specialises in the acquisition of rare pink diamonds. ADP provides investors with an easy, end-to-end solution that encompasses every step of the investment process, as well as ongoing services including secure storage, insurance and ongoing valuations.

For more information I invite you to request our 2017 Pink Diamond Investment Guide, a great tool for interested investors to educate themselves further on pink diamonds as an investment. This guide is designed as an introduction for Australian investors interested in exposure to physical pink diamonds as part of a diversified portfolio.

Anna Cisecki,

Executive Director

If you’d like to get in touch with the team at Australian Diamond portfolio. Their contact details are below.

P: 02 9238 2727 | E: info@diamondportfolio.com.au

Disclaimers: Guardian Vaults Holdings Pty Ltd, Registered Office, Scottish House, 100 William Street, Melbourne, Victoria, 3000. ACN 138618176 (“Guardian Vaults”) All rights reserved. Any reproduction, copying, or redistribution, in whole or in part, is prohibited without written permission from the publisher and/or the author. Information contained herein is believed to be reliable, but its accuracy cannot be guaranteed. It is not designed to meet your personal situation. Guardian Vaults, its officers, agents, representatives and employees do not hold an Australian Financial Services License (AFSL), are not an authorised representative of an AFSL and otherwise are not qualified to provide you with advice of any kind in relation to financial products. If you require advice about a financial product, you should contact a properly licensed or authorised financial advisor. The information is indicative and general in nature only and is prepared for information purposes only and does not purport to contain all matters relevant to any particular investment. Subject to any terms implied by law and which cannot be excluded, Guardian Vaults, shall not be liable for any errors, omissions, defects or misrepresentations (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (direct or indirect) suffered by persons who use or rely on such information. The opinions expressed herein are those of the publisher and/or the author and may not be representative of the opinions of Guardian Vaults, its officers, agents, representatives and employees. Such information does not take into account the particular circumstances, investment objectives and needs for investment of any person, or purport to be comprehensive or constitute investment or financial product advice and should not be relied upon as such. Past performance is not indicative of future results. Due to various factors, including changing market conditions and/or laws the content may no longer be reflective of current opinions or positions. You should seek professional advice before you decide to invest or consider any action based on the information provided. If you do not agree with any of the above disclaimers, you should immediately cease viewing or making use of any of the information provided.