Enquire Now

Please provide your details to reserve space at Guardian Vaults.

Enquire Now

Please provide your details to reserve space at Guardian Vaults.

Enquire Now

Please provide your details to reserve space at Guardian Vaults.

Enquire Now

Please provide your details to reserve space at Guardian Vaults.

Enquire Now

Please provide your details to reserve space at Guardian Vaults.

Most countries in the world have today adopted a paper currency fiat system that we all recognise. Issued by government decree, they are non-convertible forms of payment that are not linked to any underlying value or standard. The continued use of these paper systems relies on a perception of confidence in the value of the particular fiat currency. Historically that confidence would have taken the form of a ‘pegging’ to gold, commonly known as a gold standard.

The application of the gold standard not only had the effect of reinforcing a global fixed rate of exchange for international trade and commerce but more importantly, restricted the ability of governments to print a limitless quantity of paper currency.

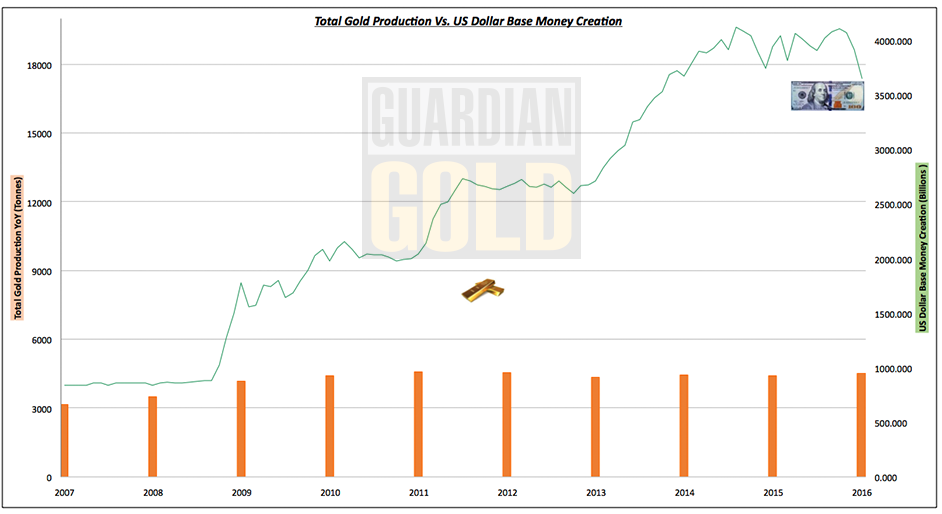

The below chart is a snapshot of the growth of the US base money over the last decade vs. the annual supply of new gold produced through mining, scraping / recycling.

Chart 1.1

Source – (1) Federal Reserve Economic Data, St. Louis Adjusted Monetary Base, Billions of Dollars, (2) GFMS Thomson Reuters Gold Survey 2017, (3) ycharts.

(Monetary base is the total amount of a currency that is either circulated in the hands of the public or in the commercial bank deposits held in the central bank’s reserves. This measure of the money supply typically only includes the most liquid currencies; it is also known as the “money base.” – Investopedia)

The acceleration of the printing of money and debt creation by the US Federal Reserve post the global financial crisis (GFC) of 2007/8 is strikingly obvious. This policy not only erodes the core principal of money as a stable medium of exchange, it also has the effect of devaluing the every-day purchasing power of the dollar (refer to Chart 1.2), planting the future seeds of an inflationary time bomb.

Chart 1.2

Source – (1) U.S. Bureau of Labor Statistics, Consumer Price Index for All Urban Consumers: Purchasing Power of the Consumer Dollar, retrieved from FRED, Federal Reserve Bank of St. Louis, (2) World Gold Council

Gold throughout this period maintained its consistent yearly supply creation, rarely exceeding the 4-tonne mark YoY. The very nature of gold dictates that a finite amount will be available to market, regardless of the demand. A limited and controlled output that both contributes to price discovery as well as maintaining a fundamental level of support.

Considering the above, the prospect of investing in assets to generate fiat based income returns is far from a risk-free proposition, regardless of how diversified your investment portfolio appears.

Here is where the gold doubting friends of ours will usually be chomping at the bit to say, “If gold is priced in dollars then it also has no underlying value”, and to a certain extent that is true. Gold is indeed priced in US dollars and does not generate a yield or a projectable rate of return.

So how do we measure the value of gold and square this to its market USD spot price?

One way to do this is by looking at the relative or fundamental value to attempt to derive gold’s value vs. the perception of confidence. The gold price has been described as the ultimate domestic and geopolitical barometer. Price performance is intrinsically linked to the health of the economy, the actions of those issuing currency and making laws. It is a physical representation, the heartbeat if you will of the ongoing belief (or lack thereof) in the prevailing system.

Take any of the major geopolitical events of the last few decades, and there have been too many to mention. When the prevailing system is remotely tested as a result of a game changing event (war, threat of conflict, financial instability etc.) you will undoubtable see a retreat to gold as the global safe haven.

In our next blog in the series we will be delving deeper into some of those game changing market events. From historical black swans to the recent Trump-trend, we’ll examine how precious metals performed in times of high volatility.

As always, please feel free to reach out to us to discuss anything touched on in the above. You can contact Guardian Gold’s in-house analyst, Patrick O’Connor on +61 2 9283 5570 or patrick@guardianvaults.com.au

Investments

From Guardian Vaults

The True Value of Gold (Part 1)

Most countries in the world have today adopted a paper currency fiat system that we all recognise. Issued by government decree, they are non-convertible forms of payment that are not linked to any underlying value or standard. The continued use of these paper systems relies on a perception of confidence in the value of the particular fiat currency. Historically that confidence would have taken the form of a ‘pegging’ to gold, commonly known as a gold standard.

The application of the gold standard not only had the effect of reinforcing a global fixed rate of exchange for international trade and commerce but more importantly, restricted the ability of governments to print a limitless quantity of paper currency.

The below chart is a snapshot of the growth of the US base money over the last decade vs. the annual supply of new gold produced through mining, scraping / recycling.

Chart 1.1

Source – (1) Federal Reserve Economic Data, St. Louis Adjusted Monetary Base, Billions of Dollars, (2) GFMS Thomson Reuters Gold Survey 2017, (3) ycharts.

(Monetary base is the total amount of a currency that is either circulated in the hands of the public or in the commercial bank deposits held in the central bank’s reserves. This measure of the money supply typically only includes the most liquid currencies; it is also known as the “money base.” – Investopedia)

The acceleration of the printing of money and debt creation by the US Federal Reserve post the global financial crisis (GFC) of 2007/8 is strikingly obvious. This policy not only erodes the core principal of money as a stable medium of exchange, it also has the effect of devaluing the every-day purchasing power of the dollar (refer to Chart 1.2), planting the future seeds of an inflationary time bomb.

Chart 1.2

Source – (1) U.S. Bureau of Labor Statistics, Consumer Price Index for All Urban Consumers: Purchasing Power of the Consumer Dollar, retrieved from FRED, Federal Reserve Bank of St. Louis, (2) World Gold Council

Gold throughout this period maintained its consistent yearly supply creation, rarely exceeding the 4-tonne mark YoY. The very nature of gold dictates that a finite amount will be available to market, regardless of the demand. A limited and controlled output that both contributes to price discovery as well as maintaining a fundamental level of support.

Considering the above, the prospect of investing in assets to generate fiat based income returns is far from a risk-free proposition, regardless of how diversified your investment portfolio appears.

Here is where the gold doubting friends of ours will usually be chomping at the bit to say, “If gold is priced in dollars then it also has no underlying value”, and to a certain extent that is true. Gold is indeed priced in US dollars and does not generate a yield or a projectable rate of return.

So how do we measure the value of gold and square this to its market USD spot price?

One way to do this is by looking at the relative or fundamental value to attempt to derive gold’s value vs. the perception of confidence. The gold price has been described as the ultimate domestic and geopolitical barometer. Price performance is intrinsically linked to the health of the economy, the actions of those issuing currency and making laws. It is a physical representation, the heartbeat if you will of the ongoing belief (or lack thereof) in the prevailing system.

Take any of the major geopolitical events of the last few decades, and there have been too many to mention. When the prevailing system is remotely tested as a result of a game changing event (war, threat of conflict, financial instability etc.) you will undoubtable see a retreat to gold as the global safe haven.

In our next blog in the series we will be delving deeper into some of those game changing market events. From historical black swans to the recent Trump-trend, we’ll examine how precious metals performed in times of high volatility.

As always, please feel free to reach out to us to discuss anything touched on in the above. You can contact Guardian Gold’s in-house analyst, Patrick O’Connor on +61 2 9283 5570 or patrick@guardianvaults.com.au

Disclaimers: Guardian Vaults Holdings Pty Ltd, Registered Office, Scottish House, 100 William Street, Melbourne, Victoria, 3000. ACN 138618176 (“Guardian Vaults”) All rights reserved. Any reproduction, copying, or redistribution, in whole or in part, is prohibited without written permission from the publisher and/or the author. Information contained herein is believed to be reliable, but its accuracy cannot be guaranteed. It is not designed to meet your personal situation. Guardian Vaults, its officers, agents, representatives and employees do not hold an Australian Financial Services License (AFSL), are not an authorised representative of an AFSL and otherwise are not qualified to provide you with advice of any kind in relation to financial products. If you require advice about a financial product, you should contact a properly licensed or authorised financial advisor. The information is indicative and general in nature only and is prepared for information purposes only and does not purport to contain all matters relevant to any particular investment. Subject to any terms implied by law and which cannot be excluded, Guardian Vaults, shall not be liable for any errors, omissions, defects or misrepresentations (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (direct or indirect) suffered by persons who use or rely on such information. The opinions expressed herein are those of the publisher and/or the author and may not be representative of the opinions of Guardian Vaults, its officers, agents, representatives and employees. Such information does not take into account the particular circumstances, investment objectives and needs for investment of any person, or purport to be comprehensive or constitute investment or financial product advice and should not be relied upon as such. Past performance is not indicative of future results. Due to various factors, including changing market conditions and/or laws the content may no longer be reflective of current opinions or positions. You should seek professional advice before you decide to invest or consider any action based on the information provided. If you do not agree with any of the above disclaimers, you should immediately cease viewing or making use of any of the information provided.